Why Local Matters

The 9 key findings to why local matters and the positive impacts on your community.

The 9 key findings

to why local matters:

Recently, it seems that policies are benefiting larger corporations, although a growing volume of research is proving we should be doing just the opposite. We assume that shopping and supporting our local businesses is important to our community. But what are the measurable impacts that occur as a result? Well, we’re here to break it down for you! These nine key findings shine a light on why localized business is so important in supporting our economy, our culture, and our future. Let’s take a look…

Encourages Start-Ups and Existing Businesses

Strong Economic Returns

Increase in Jobs, Wages, and Benefits

Increased Donations for Community Groups

Better Public Services

Social and Civic Well-Being

Keeps Our Communities Unique

Better Selections, Prices, and Customer Service

Reduced Impact on the Environment

1. Encourages Start-Ups and Existing Businesses

Buying locally is a small commitment that can easily turn into a movement. By patronizing local shops and services, you’re investing in the imagination of your community. Where there is one great innovation, there are more ideas in the making.

A new business can be a catalyst for new jobs. Local economic growth can attract new talent who may in turn invest in start-ups of their own. The spark that one start-up creates can become a shift in the way an entire community operates.

2. Strong Economic Returns

Local businesses recirculate a greater share of every dollar, as they create locally-owned supply chains while investing in their employees. Simply put, when money is spent locally, it can be re-spent locally. This creates a positive chain reaction, where an increase of local economic activity yields more jobs, a stronger tax base, and more.

Small-scale, locally-owned businesses create communities that are more prosperous, connected, and generally better off across a wide range of metrics. When we patronize these independent shops and services rather than national chains, a significantly greater portion of our money is then cycled back through the local economy – to make purchases from our friends’ businesses, to aid our neighbors in need, and to support our local farms – ultimately strengthening the base of our whole community.

On average, when you spend $100 locally, $73 stays local, and $27 leaves. In contrast, if you shop at a non-local business, only $43 stays, while the remaining $57 leaves the local economy.

3. Increase in Jobs, Wages, and Benefits

Collectively, small local businesses are the largest employers in the United States. This means that there are more Americans working for businesses comprised of fewer than 100 employees than there are people employed by a larger company.

Research shows that small businesses employ more people per unit of sale. They also retain more employees during times of economic hardship, such as in a recession. This isn’t just an empty figure, either. Local businesses are more likely to retain workers because they have a genuine connection with their employees, whereas larger companies see their people as more dispensable.

While not feasible for every small business, there is evidence that locally-owned shops and services are linked to higher growth of income over time in comparison to big-box companies.

4. Increased Donations for Community Groups

Locally owned businesses contribute more to local charities, teams, events, and initiatives than any of their national counterparts.

Because they are owned by our own community members, local businesses have a real investment in the place you call home, meaning they are more likely to invest in what’s important to them. It also less likely to leave, as they are proven to be more committed to the neighbors they get to call friends, family, and peers.

When you buy locally, you’re not padding the pockets of big corporations. You’re helping families put food on the table, send their children to dance lessons and plan for their futures.

5. Better Public Services

While many types of shops and services generate revenue, it comes at a deficit to the community. Local businesses, however, generate more tax revenue for cities, with less cost.

Recent studies have suggested that local businesses generate the best net fiscal result, at a rate of about $326 per 1,000 square feet. The comparison to that of big-box retailers is astonishing: they generate a deficit of –$426 per 1,000 square feet.

One of the greatest factors of that negative impact is the costs incurred by travel, as big retailers have a much greater rate of spending on shipping from a much longer distance.

6. Social and Civic Well-Being

A thriving community with a variety of local businesses is proven to strengthen the middle class while also enriching the social capital, civic engagement, and general well-being of its people.

This comes in stark contrast to the presence of big-box retailers, who undermine social capital and civic participation.

7. Keeps Our Communities Unique

There is real magic that small businesses bring to a community, and a lack of them does not go unnoticed. They bring diversity to a town by ushering in folks with a variety of backgrounds and experiences. This range and wealth of familiarities can enrich, enliven, and engulf your community in culture it wouldn’t find anywhere else.

In addition to an uptick in diversity, studies show that small businesses help drive equality in a community.

8. Better Selections, Prices, and Customer Service

Communities are also benefitted by local shops knowing their town’s demographic. A college town is more likely to lean towards the needs of students, staff, and faculty, whereas a more rural area may be tailored to help support the farming community. Without local businesses, that tailored experience is often lost.

Additionally, local businesses often employ people with a wealth of knowledge about the products they sell. There is a richer experience in supporting a local shop or service as owners and employees not only feel passionate about what they do but also want to know the people who support them.

9. Reduced Impact on the Environment

You don’t have to look far to see why buying locally can benefit the environment.

There are a variety of transportation costs and environmental tolls each time you buy online, patronize a big-box retailer or purchase groceries from a chain. Transporting items from A to B is a massive contributing factor to pollution, so when the items you buy are produced down the street instead of across the country, you are helping reduce your environmental footprint.

In the case of food, there are additional benefits when you source locally. Produce grown by small local businesses is not only more likely to be seasonal – thereby saving on energy and water use – but also more nutritious, as it’s picked or used at peak ripeness, without having to take long transport time into consideration.

Your actions matter!

Giv Local is B-Certified!

Giv Local’s mission is to interrupt the flow of processing fees and redirect those funds to local nonprofits. As a force devoted to helping one’s neighbors, rather than letting traditional processing fees…

Giv Local is proud to announce its official status as a Certified B Corporation!

What is a B Corporation?

Certified B Corporations are businesses that have been evaluated and verified to meet the highest standards of social and environmental performance, public transparency, and legal accountability to balance purpose and profit. Today, people care more than ever about the positive impact of the brands they consume. B Corps work to accelerate the culture shift in which the power of business is used to tackle society’s greatest challenges, from climate change to anti-racism to equity for all. Together, the B Corp community is dedicated to using business as a force for good.

What does it mean to be certified?

The certification for a pending B Corp does not just evaluate a specific product or service of your business but instead assesses the positive impact of a company’s day-to-day operation. The B Impact Assessment is the only certification that measures a business’s entire social and environmental performance – from supply chain to input materials to charitable giving to employee benefits. Giv Local has farr exceeded the minimum verified score on the B Impact Assessment – a rigorous system of evaluating a company’s impact on its workers, customers, community, and the environment – while also committing to the transparency of operation.

Certification also includes committing to the B Corp Declaration of Interdependence, where companies pledge to believe:

• That we must be the change we seek in the world

• That all business ought to be conducted as if people and place matter

• That, through their products, practices, and profits, businesses should aspire to do no harm and benefit all

• To do so requires that we act with the understanding that we are each dependent upon another and thus responsible for each other and future generations

What does this mean for Giv Local?

Giv Local’s mission is to interrupt the flow of processing fees and redirect those funds to local nonprofits. As a force devoted to helping one’s neighbors, rather than letting traditional processing fees land directly in the pockets of big corporations, it should come as no surprise that our values directly reflect those of a B Corp. Our certification as a B Corp is a step to further our commitment to working purposefully and sparking positive change in our communities. We stand amongst nearly 3,500 other companies spanning 150 industries and 74 countries, all with one unifying goal to use business as a force for good.

How To Choose A Credit Card Processor For Your Non-Profit

If you accept credit card payments online or in-person, there are two main options. You can use Paypal, Square, Stripe or another third party payment processor, or you can set up a merchant account…

If you accept credit card payments online or in-person, there are two main options. You can use Paypal, Square, Stripe or another third party payment processor, or you can set up a merchant account. In addition, you’ll want to evaluate each processor on five criteria. Each has pros and cons, so let’s break them down and show you how to choose a credit card processor for your non-profit.

If you already know you’d like to set up a merchant account but you just need help choosing a credit card processor, scroll down to “Should I set up a merchant account?” and walk through the straightforward process.

Here are some basic concepts you’ll need to know before we dive in.

The 5 Criteria for Comparing Credit Card Processors

1 - How much does it cost?

Aside from just the transaction fee percentage, you’ll need to find out if a processor charges a monthly fee or a flat per-transaction fee. It’s not just how much they charge, but how often they charge it. Flat, fixed fees are more predictable and transparent--but that might not be the best for cost conscious business. By avoiding fixed rates, processors end up charging variable rates for different card types, so depending on your clientele, this could save you money or cost you more. In addition to the variable rates, your average transaction size and average quantity of transactions could also determine if you come out in the red or black.

Most processors, regardless of fee structure, distinguish between card-present (CP) and card-not-present (CNP) transactions. CNP transactions occur when a merchant keys in a credit card number by hand, and they are always more expensive because they carry an increased risk for fraud.

No one likes fees. So, you should know that they are all over statements and contracts in the processor world and some aren’t very transparent.

Here are some fees you’ll want to ask about and tally up:

Compliance fees

Interchange fees

Statement fees

Cancellation fees

Gateway access fees

Finally, outside of the rates, you’ll want to consider what eCommerce or Point of Sale (POS) devices you’ll need to use. Not all processors work with all POS machines, so you may need to include the up-front cost for new equipment if you find a great rate.

2 - Is it secure and does it protect me from fraud?

The main way to assess security is by using Payment Card Industry Data Security Standard (PCI-DSS) guidelines. Essentially, these guidelines dictate that your processor’s online payment system needs to be documented and accounted for. For brick and mortar sales, compliance is based on the hardware standards of POS systems.

3 - Does it accept different payment types?

In the age of COVID-19 you’ll want to consider having touchless or contactless payments available. These use Near Field Communication (NFC) and communicate with cards, smartphones, smart watches, and other wearable devices. Touchless payment systems and systems that accept chip cards are also most secure. It’s common for credit card processors to have all of these compliance factors included in their service and offerings.

4 - Does it work better with everything else?

Some processors offer POS software to accompany and integrate natively with your system and hardware. Some have a long list of partners you can choose from. The factors that will impact this decision for you will be how complex your business is. Do you have multiple locations? Do you have lots of inventory? In general, native integrations make reporting, compliance, and usability better.

5 - What happens when something goes wrong?

Depending on your business, you’ll want to evaluate if having 24/7 access to customer support is important. For some folks, it’s important to know you’re going to connect with a real live, breathing human being on the other end.

Should I go with a Third Party Processor?

Now that you know how to evaluate different types of credit card processors, we can dive into whether or not you’ll want to select a third party processor or set up a merchant account.

Third-party processors are easy to set up and easy to use. Most of them set you up with a flat rate, which means your statements will be more predictable and easier to understand where the money is flowing.

The only downsides are that they typically cost more in fees and they can sometimes take more time to transfer funds to your bank account.

In fact, Square was in the news for holding money. Square is optimized to get you set up fast, and they deliver. Their speed comes from their spartan application process. This policy has caught the limelight due to increased merchant complaints. How? By skipping some steps at onboarding, it means that Square must hold funds and can sometimes trigger surprise account cancellation by their fraud prevention department. What’s worse is that some merchants report that Square hasn’t had the customer support capacity to quickly remediate these issues, which means more merchants without an account and without their money.

If you really need predictable, flat-rate pricing but you also don’t want to pay extra fees to sign up with a third-party processor, we can provide you with options at Giv Local. Go here to check out our pricing options.

Here are some of the most popular third-party payment processors:

Square

Square is most easy to use for small, brick, and mortar businesses. Their integrations with familiar tools like the iPad make point of sale systems a breeze to learn and difficult to mess up. Square charges a 2.6% transaction fee for in-person payments. Manually entered card payments cost a bit more (3.5% plus 15 cents), as online and over the phone transactions demand a higher fee due to greater fraud risks. See Square’s pricing page, here.

Before choosing Square, be sure to read some of the risks inherent to their quick onboarding process. Here’s a NY Times article covering some of the challenges merchants face with Square.

Stripe

Stripe is the web developer’s processor. They make it easy for you to set up your web business to securely accept credit card payments online. Online credit card transactions cost 2.9% plus 30 cents. In-person card payments cost merchants 2.7% plus 5 cents. Stripe's web tools make it easy to customize the payments experience, making it ideal for subscription services, marketplaces, e-commerce stores, and B2B platforms. In addition to processing, Stripe also offers a range of software add-ons, including the Stripe Dashboard, Stripe Terminal, Stripe Checkout, Stripe Billing, and Stripe Connect. See Stripe’s pricing page, here.

Paypal

Paypal is ideal for person-to-person transactions or small businesses with fewer, larger transactions. For in-person sales, PayPal charges 2.7% per transaction, while online transactions cost 2.9% plus 30 cents per transaction. Payments made via PayPal's virtual terminal cost 3.1% plus 30 cents per transaction, and manually keyed transactions cost 3.5% plus 15 cents per transaction.

For in-person card acceptance, PayPal offers Here, a mobile credit card processing and point-of-sale system. In addition to credit card processing, PayPal offers robust customer service and merchant support and a streamlined financing program for merchants. For business services, PayPal integrates with software providers including BigCommerce, Shopify, and QuickBooks. See Paypal’s pricing page, here.

Quickbooks Payments

Truthfully, QuickBooks Payments is set up for small business accounting, but it also offers credit card processing. If you’re already using Quickbooks, you’ll want to consider this one. QuickBooks Payments lets merchants accept credit cards, debit cards, and ACH bank transfers and charges flat, per-transaction fees that are pretty transparent and clearly laid out.

For in-person payments QuickBooks charges 2.4% + 25 cents per transaction. Invoiced payments cost 2.9% + 25 cents per transaction fee, and manually keyed payments cost 3.4% + 25 cents per transaction. QuickBooks also requires you to have your own merchant account for credit card processing. See Quickbooks Payments pricing page, here.

Here’s a recap table that

outlines each of these third party processors:

Should I set up a Merchant Account?

The main benefit of setting up a merchant account is that once you’ve done it, you save money.

If you’re like most nonprofits, you probably want to find a way to make a merchant account work since it can save you considerable money on transactions--and in the age of COVID-19, refunds--but setting up all paperwork makes it feel impossible. That’s where we come in.

Our mission at Giv Local is to help nonprofits secure recurring revenue from their local business communities. So, we did the work and put together a 4 step process that will help you figure out how to choose the right credit card processor for your non-profit.

Step 1 - Identify and List Your Specific Needs

What types of payment cards do you plan to accept?

From which countries do you plan to accept payment?

How many payment terminals will you need?

Do you plan to accept payments online?

Step 2 - Identify and List Competing Payment Processors

As you do your research, you’ll want to log your findings in an easy to reference way. Remember those 5 criteria at the beginning of the post? You’ll want to use those here in this step.

Here they are again for easy reference:

How much does it cost?

Is it secure and does it protect me from fraud?

Does it accept different payment types?

Does it work better with my systems?

What happens when something goes wrong?

This will make life easier later when you need to do your evaluation, but it will also make your conversation with your board much easier. You’ll have all the competing processors lined up in an easy to understand format.

Step 3 - Look for Key Components of each Contract

Is it a single contract deal?

If you want to process American Express payments, you might require a separate agreement with Amex as well as with your payment processor. This depends on a few factors like how much dollar volume and who else the credit card company is working with. It’s complicated so we won’t go into that here, but you should be aware of this detail when you sign.What fees are involved?

There can be monthly fees, transaction fees, fees for special types of credit cards, and fees for transferring funds to your bank account. There are as many fees as there are types of insects. It can be a lot. If it’s not confusing enough already, sometimes your contract might look like you’re paying $0.25 per line item, but then there are separate fees added on that are all multiplied by the same transaction number. This means your actual rate might be much higher than the rate you think you’re paying.Do you need to maintain a minimum balance?

Balance that you are required to maintain in your reserve account for settlement if any.When are funds deposited?

When you will receive funds for the credit and debit card transactions processed on your behalf. Typically, merchants receive the funds one to three days after the transaction date but merchants that have had bad fraud experience may have to wait longer.When does it end?

Expiry date and whether the contract is automatically renewed unless you give notice. You should also see if there are any consequences for early contract termination.

Step 4 - Verify Your Processor Is Secure

Handling payment card information requires you to ensure that the information is secure. To do this, you’ll have to check PCI-DSS guidelines to ensure that credit cards received by your organization will be adequately protected.

Here are some tools that PCI has laid out for you on their website:

Why Giv Local?

Giv Local is a merchant servicing company bringing purpose to payment processing. A (pending) B-Corp Certified, Benefit Corporation, Giv Local’s mission is to interrupt the flow of processing fees and redirect those funds to local nonprofits…

Processing with a Purpose

Giv Local is a merchant servicing company bringing purpose to payment processing. A B-Corp Certified, Benefit Corporation, Giv Local’s mission is to interrupt the flow of processing fees and redirect those funds to local nonprofits. By repurposing fees for charitable causes, annual donations will be made in the name of each partnered business and paid toward a nonprofit of that business’s choosing. It’s a force devoted to helping one’s neighbors, rather than letting traditional processing fees land directly in the pockets of big corporations.

How It Works

Giv Local aims to empower businesses with the ability to give back to organizations of their choosing, at no extra cost, on a recurring basis.

Traditionally, businesses process payments with their bank, Square system, or other third-party vendors, each of which is set up with the same processing companies who are unaware and disconnected from the local communities of the businesses who pay them. The processing system and its fees are largely invisible to consumers, but Giv Local hopes to change that by making people more conscious of where their money goes.

Traditionally, the average credit card processing fee is around 2% or more per transaction, all of which typically goes to a large credit card processing company. When someone uses a credit card to make a purchase with a Giv-partnered business, 20% of that business’s processing fee will be donated to a nonprofit of their choosing.

What Sets Us Apart

Transparent Pricing

Each business has the option to choose from:

Interchange Plus: A fixed markup to interchange (VISA, MasterCard, Discover, etc.) charges. This amount will vary depending on the risk of the business or industry.

Cash Discount: The customer pays the processing fee and the business pays a low flat monthly fee.

Flat Rate Pricing: Each transaction costs the same percentage + transaction fee, regardless of the wholesale cost.

Unique Model

While only a few give-back processing companies exist, their mission does not focus on local communities – instead, donations are given to a small group of preselected organizations, and the funds donated are based on a percentage of the merchant servicing company’s profits.

On the other hand, Giv Local’s per-transaction model gives power to its partners, and the amount donated annually is based on how much each partnered company processes, thereby widening the range of local impact. The money donated falls only in the hands of nonprofits in your local community, chosen specifically by each partnered business.

Personalized Packages

Giv Local is equipped to match or beat your current merchant servicing fees. While offering flat rate, interchange-plus, and cash discount systems, Giv Local will collect and analyze your existing processing statements to provide the best route to partnership. By understanding your existing processing, they can create a system that maximizes the impact your donation can make in your community.

Giv Local can also design custom pricing packages for larger businesses, associations, and financial institutions.

To learn more or start a conversation with one of our reps, check out our pricing page.

Customizable Impact

Giv Local partners not only have the option to donate to charities of their choosing but also have the option to widen their impact by selecting multiple recipients. With our split model, a business can divide their donation between two nonprofits, where each will receive one half of their 20% donation. With our collaborative model, a business with several locations can opt to focus all donations on one singular entity.

With the individual model, a business with several locations can donate as each sees fit, thereby dispersing their impact on several different causes.

Adaptable

Giv Local can use nearly any processing device on the market. From EMV to online virtual terminals, shopping carts, mobile, and much more, Giv Local is proud to offer processing solutions for all types of businesses. Spanning a wide range of equipment from bare-bones to above-and-beyond, there’s something for everyone.

Whether it’s a restaurant, retail store, local government, freelance designer, local bank, or e-commerce website, Giv can work for you. Check out more on our products page.

Secure

Giv Local uses the same technology as big banks, so the entire process – from encryption to authorization – is as safe as any other transaction.

Additionally, partnered businesses can be confident that the funds they raise for local nonprofits are directed to the proper recipients. In becoming B-Corp Certified, a bi-annual study is conducted which analyzes Giv Local’s performance and ensures its commitment to a 20% donation.

Giv Local also has a certified accountant who performs an annual attestation of the business, further guaranteeing that no less than 20% is donated back to its partners.

Fast

As soon as all paperwork is complete, Giv Local can – in most cases – have your new account live in just two business days, and that’s not all.

Once a company is set up to process with Giv Local, they will immediately see donations beginning to add up. These figures, as well as other reports, are available in Giv Local’s own easy-to-navigate digital platform.

Human

“We wanted to think of it not as B2B or B2C, but H2H – Human to Human.”

- Christian Baum, co-founder

At its core, Giv Local is community-minded. Putting people before profits can’t be done without a truly human approach. That’s why we offer the ultimate customer service – including annual reports which outline processing and impact data - delivered by real humans.

There will always be a human to advocate for you. No robots or automation, ever.

The Team Behind It All

The founders of Giv Local saw the need for innovative, sustainable, and socially responsible forces for good, and they rose to meet the occasion. Meet our team.

Founding Givers

Out of the belief that anything and everything in business can be made better, Giv Local was born. Crafted by three friends who bonded first over their love for gaming, Shizuka Buckley, Sam Buckley, and Christian Baum also found that their professional backgrounds made the perfect…

Out of the belief that anything and everything in business can be made better, Giv Local was born. Crafted by three friends who bonded first over their love for gaming, Shizuka Buckley, Sam Buckley, and Christian Baum also found that their professional backgrounds made the perfect combination to bring a purpose-based credit card processing business to life.

Launched in 2017, the trio poured extensive research and perseverance into the project, laying a foundation that could be not only impactful, but also sustainable. Leaving their former careers behind and bringing years of experience along for an altogether new ride, the founder pursued their life-long desire to make a lasting impact on their community.

Meet the team…

Shizuka Buckley

Shizuka Buckley is a former manager for Chloe & Isabel, a popular women-owned jewelry company. Beyond her extensive background in sales and marketing, she is passionate about helping others, finding a special connection to empowering and mentoring female entrepreneurs to succeed in their own businesses. While she has always worked to benefit others, Shizuka (otherwise known as the Charity Sorceress) believes Giv Local is an opportunity to not only aid other businesses, but also amplify entire communities.

Sam Buckley

Sam Buckley’s long career working with big banks has landed him the title of Giv Local’s very own Processing Druid. Having dedicated his entire career to supporting businesses and nonprofits, he has recognized the industry’s all-too-common sales-first focus and hopes to disrupt the norm by prioritizing the impact of giving back.

Christian Baum

Christian Baum is known as the group’s serial do-er and has gained his experience in a variety of ways: as a freelance graphic designer, co-founder of several socially-responsible companies, freightliner truck driver, and – most recently – Design Yeti for Giv Local. His affinity for new experiences has allowed him to better connect, impact, and invest in his community. This beyond-the-box thinking is what has led Christian to brand Giv not as B2B or B2C, but H2H… Human to Human.

Giv Local Partners with Kish Bank

Giv Local is thrilled to announce a new “gift back” program with Kish Bank… Both local to State College, PA, the two civic-minded organizations have collaborated to maximize the social change in the community they call home…

Giv Local is thrilled to announce

a new “gift back” program with Kish Bank.

Both local to State College, PA, the two civic-minded organizations have collaborated to maximize the social change in the community they call home.

Businesses using Kish Bank’s credit and debit card processing services now also benefit from Giv Local’s payment solutions. When a business leverages Giv Local’s services, a portion of the business’s card processing fees will be redirected as a donation to a verified nonprofit of the company’s choosing. As an additional benefit to the program, Giv Local’s rates are competitive and can match or beat what a partnered business would pay for a different processor.

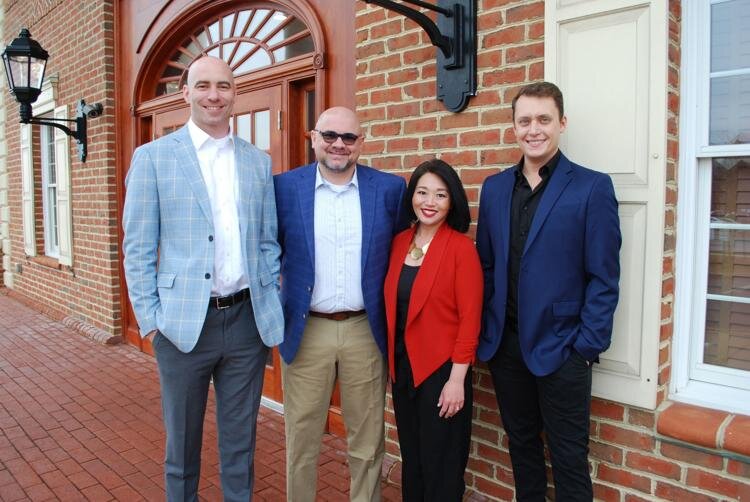

From the left, Kish Bank COO Greg Hayes, Sam Buckley, Shizuka Buckley and Christian Baum, Giv Local co-founders. Photo provided by Kish Bank.

Giv Local founders Shizuka Buckley, Sam Buckley, and Christian Baum, initially bonded over their common love of gaming and shared mission to make meaningful change in their communities. In partnering with Kish Bank, the companies have bonded over their common belief that the greatest impact can be made when efforts for change are backed by the businesses, organizations, and individuals of one’s community.

“The health of our communities and the role Kish plays is, and always has been, mission-critical to us,” says Kish Bank COO and president Greg Hayes. “Our partnership with Giv Local is just one opportunity we can give our customers to be involved in making a difference in areas that matter to them.”

Kish Bank has been known for its commitment to the community, identifying it as both a core value and a strategic priority for the business. Working in conjunction with nonprofit organizations from the very start, Kish aims to improve the quality of life wherever its customers, partners, and employees live and work.

Giv Local has also been crafted with community at its core, aiming to give leverage to those who have wanted to make a change but needed an extra boost to make an impact. “We’re giving small businesses, who may not have the budget to give back to organizations they are passionate about, a means to give – without costing them extra money,” notes Giv co-founder Sam Buckley.